Market insights with Mike: Vehicle activity on the rise in COVID-19 aftermarket analysis

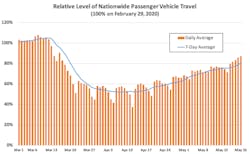

Since the onset of the pandemic and stay-at-home orders, one question hanging over the industry and the economy has been, “Where is the bottom?” Over the past few weeks, it appears that the lowest level of vehicle activity is behind us. As charted below, vehicle travel has steadily crept back up:

As we start to see indicators trend upward again, it’s time to start planning for the “new normal” of the next several months and the future ahead. This edition of Market Insights with Mike presents updated results on our survey with the aftermarket regarding COVID-19 impact and outlook, followed by legal considerations for the industry. If you’re reading this, please continue to take our survey monthly so that we can continue to monitor and respond to the impact.

Industry Sentiments and Trends

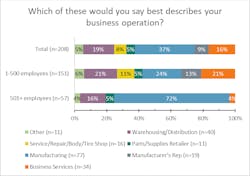

Throughout the past two months, we have been gauging the pandemic’s impact on the industry. The sentiment was predominantly similar on business performance impact and outlook between early April and late April/early May. In this issue, we compare some differences between small (1-500 employees) and medium/large businesses (501+ employees), and between organization types. We also compare these trends to related industries – manufacturing and wholesale and trade.

Through May 18, we received 208 completed responses to our survey, broken out as follows:

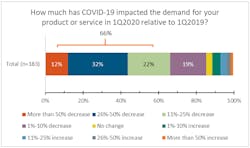

On the whole, two-thirds of aftermarket companies are seeing demand reductions in excess of 10 percent:

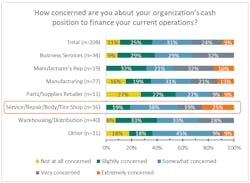

As such, one-third of companies are highly concerned about their cash position – while the sample size is small, this is particularly pronounced with service and repair shops. This is not terribly surprising given consumers’ hesitancy to take their vehicles in for service, in combination with reduction in driving activity.

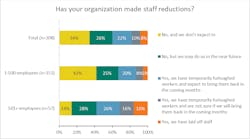

Interestingly, larger companies are more likely to have reduced staff and/or to have closed a facility:

Upon reflection, several factors may be at play: smaller companies are more likely to be family-owned, and the decision to lay off staff may be more difficult because of close or family relations. Further, smaller companies may be required to maintain pre-pandemic employment levels to secure government assistance, and larger companies are more likely to be publicly traded, with swifter calls to action to demonstrate fiscal stewardship.

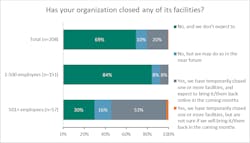

Larger companies’ higher likelihood of closing a facility makes sense as they are more likely to have multiple facilities, and may need to close a facility for disinfection or deep cleaning in the event of an employee testing positive for COVID-19, and/or adjust production schedules based on product demand.

About half of the industry is experiencing disruptions in their supply chain:

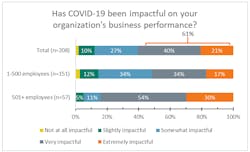

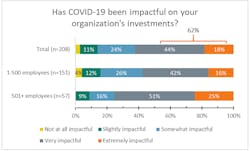

Overall, impacts on business performance and investments have been quite pronounced – nearly two-thirds are experiencing a high level of impact, more so for larger companies:

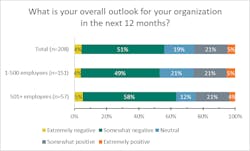

As such, it is not a surprise to see that overall outlook skews negative:

On average, larger companies are slightly more pessimistic, and manufacturing companies even more so: 69 percent are “extremely negative” (5 percent) or “somewhat negative” (64 percent).

Hanover Research reports similar impacts in the manufacturing and wholesale and trade industries: negative impacts include decreases in sales (48 percent), demand (41 percent), and productivity (34 percent), along with supply chain disruption (34 percent) (Source: Hanover Research, based on survey responses from 58 companies from May 5-9, 2020).

As with the gradual increase in VMT, in manufacturing and wholesale and trade more companies anticipate an increase in their organizations’ topline, while fewer companies anticipate a decrease in the next three months:

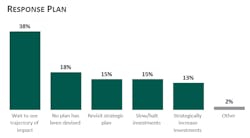

Finally, Hanover finds that companies are largely in a “wait and see” mode in these industries:

Given the state of uncertainty of further COVID-19 incidence development, government restrictions, and reopening plans, it is not surprising that companies are taking this approach. That one-sixth of companies do not have a plan is unexpected.

Legal considerations for auto care industry businesses

As the auto care industry continues to serve customers, many shop and factory owners have contacted their legal counsel on appropriate practices and potential liability. Auto Care’s legal team advises that “While there is no foolproof way to insulate a business from liability, taking reasonable steps and implementing governmental recommendations on social distancing and other preventative measures (PPE, etc.) will enable a business owner to demonstrate reasonableness and social responsibility.”

Shop owners and facility managers should be mindful of adhering to the most stringent applicable laws in considering their duty to provide a healthful and safe workplace for their employees. Beyond the general OSHA requirement to maintain a safe workplace, owners and managers should be cautious to avoid raising issues related to discrimination, leave (paid and unpaid), wage and hour requirements, immigration, whistleblower protection, health and safety recordkeeping and reporting, workers’ compensation, and requirements to post notices related to new laws and regulations.

Social distancing practices that many establishments have implemented include proximity of workers to each other and customers, prohibition of physical contact and sharing equipment, use of personal protective equipment, providence of cleaning/disinfection supplies, staggered scheduling, and limitations on gatherings (e.g., meetings).

Naturally, business owners are concerned with the potential for being held liable in the event a customer claims being infected with COVID-19 as a result of entering the premises of a business establishment. It is worth noting that in some jurisdictions an individual is deemed to “assume the risk” when voluntarily subjecting himself or herself to a known peril – but even in these circumstances, the facility owner must take objectively reasonable steps to protect the public. As such, an individual may reasonably be viewed as bearing responsibility with news/media coverage of COVID-19 and related recommendations and orders to avoid unnecessary travel and to practice social distancing.

Another issue is where, when, and how was COVID-19 contracted. It will be difficult for customers to prove causation given the nature of the virus and the ongoing inability to pinpoint where and when people have contracted the virus. As stated above, taking reasonable steps and implementing governmental recommendations on social distancing will enable a business owner to demonstrate reasonableness and social responsibility. You are urged to consult with your own legal counsel to obtain advice applicable to your specific circumstances.

Information provided by Auto Care Association